Are Wedding Expenses Tax Deductible

These are just a few of the wedding related expenses newlyweds may be able to deduct at tax time. A fee waiver a tax write off and a warm glow from donating to a good cause.

5 Expenses You Never Knew Were Not Tax Deductions Lovely

And we have some good news that will definitely help you get through it.

Are wedding expenses tax deductible. Your guests will feel great while giving back and celebrating you at the same time and you will get a tax deductible. Writing off even a fraction of the costs as a business expense could save you a bundle. Below weve shared seven tax deductions you dont want to miss if you are a wedding planner.

Are you a wedding planner. To pan out these are the ways you can make your wedding expenses tax deductible. The irs has specific guidelines about what you can and cant deduct so you need to make sure youre prepared.

Are wedding expenses tax deductible the actual costs of the wedding are deemed personal expenditures. If you are paying a ceremony fee it may be tax deductible. But wait though tax write offs may not be top of mind when you are planning your wedding with careful planning there are some ways you can garner a tax deduction or two.

Unfortunately the odds are against you. And donations are tax deductible so it is a great opportunity for both your guests and you. If not ask whether the church waives ceremony fees for members who donate at a certain level.

If youre planning on snagging any of these write offs be sure to get the proper documentation to prove your claim. Weddings are expensive so it is too bad that they arent tax deductible. Here are the creative ways.

A post wedding tax break can come from more than just how you and your partner decide to file every april. Whos filing their first tax return as newlywedswhile doing your taxes isnt always the most enjoyable task the only way around it is through it. Even if you invite lots of your customers vendors and business associates your wedding or your childs probably isnt deductible.

Tax write offs for your wedding. But with careful planning there are some ways you can achieve a tax deduction. It may be worth upping your donations for the year to get a triple benefit.

It might be tempting to write off wedding expenses as a far fetched business expense but dont go there. The only permissible way to obtain a tax deduction from the irs for your wedding expenses is if they meet the criteria for charitable contributions and the person claiming the deduction is the one footing the bill. It turns out some of the purchases youre making for your wedding day can be tax.

Hence not tax deductible. Wedding planners are in a unique business which means youll have business expenses specific to the work you do which can lower your taxable income. Wedding expenses arent just worth it for a beautiful ceremony and awesome receptionsome of those expenses might actually be tax deductible.

A 58k Wedding 20k For Raising Twins Beer And A Lego Set

A 58k Wedding 20k For Raising Twins Beer And A Lego Set

:max_bytes(150000):strip_icc()/28061847524_d276393b0a_k-226e784d8d3846f4a1491612274b125d.jpg) Newlyweds Money Saving Tips For Filing Your Tax Return

Newlyweds Money Saving Tips For Filing Your Tax Return

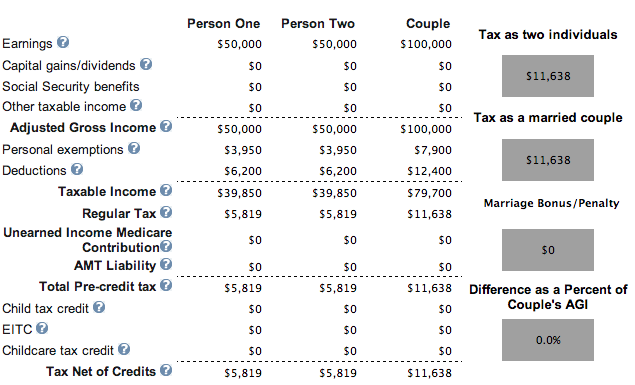

At What Income Level Does The Marriage Penalty Tax Kick In

At What Income Level Does The Marriage Penalty Tax Kick In

As of 2012 average american wedding costs ranged from 15000 in alaska to 76000 in new york city.

If not ask whether the church waives ceremony fees for members who donate at a certain level. It has been a matter of controversy between the itdepartment and the person incurring the expenses as to quantum of expenses actually incurred. A fee waiver a tax write off and a warm glow from donating to a good cause. Weddings are expensive so its unfortunate that they arent tax deductible.

Tax deduction refers to claims made to reduce your taxable income arising from various investments and expenses incurred by a taxpayer. The straight forward answer is no. Hence not tax deductible. Even if you invite lots of your customers vendors and business associates your wedding.

Thus income tax deduction reduces your overall tax liability. It is a kind of tax benefit which helps you save tax. It might be tempting to write off wedding expenses as a far fetched business expense but dont go there. First the big fat wedding expenditures are incurred in cash mostly.

Writing off even a fraction of the costs as a business expense could save you a bundle. And we have some good news that will definitely help you get through it. But with careful planning there are some ways you can achieve a tax deduction. Wedding expenses arent just worth it for a beautiful ceremony and awesome receptionsome of those expenses might actually be tax deductible.

The only permissible way to obtain a tax deduction from the irs for your wedding expenses is if they meet the criteria for charitable contributions and the person claiming the deduction is the one footing the bill. It may be worth upping your donations for the year to get a triple benefit. Here are the creative ways. But wait though tax write offs may not be top of mind when you are planning your wedding with careful planning there are some ways you may be able to garner a tax deduction as you prepare to head down the aisle.

These are just a few of the wedding related expenses newlyweds may be able to deduct at tax time. In the recent past the income tax department has been concentrating on collecting information with regard to expenses on marriage as well as other expenses by utilising power under section133a of the income tax act.

Quick And Dirty Guide To Freelance Taxes Skillcrush

Quick And Dirty Guide To Freelance Taxes Skillcrush

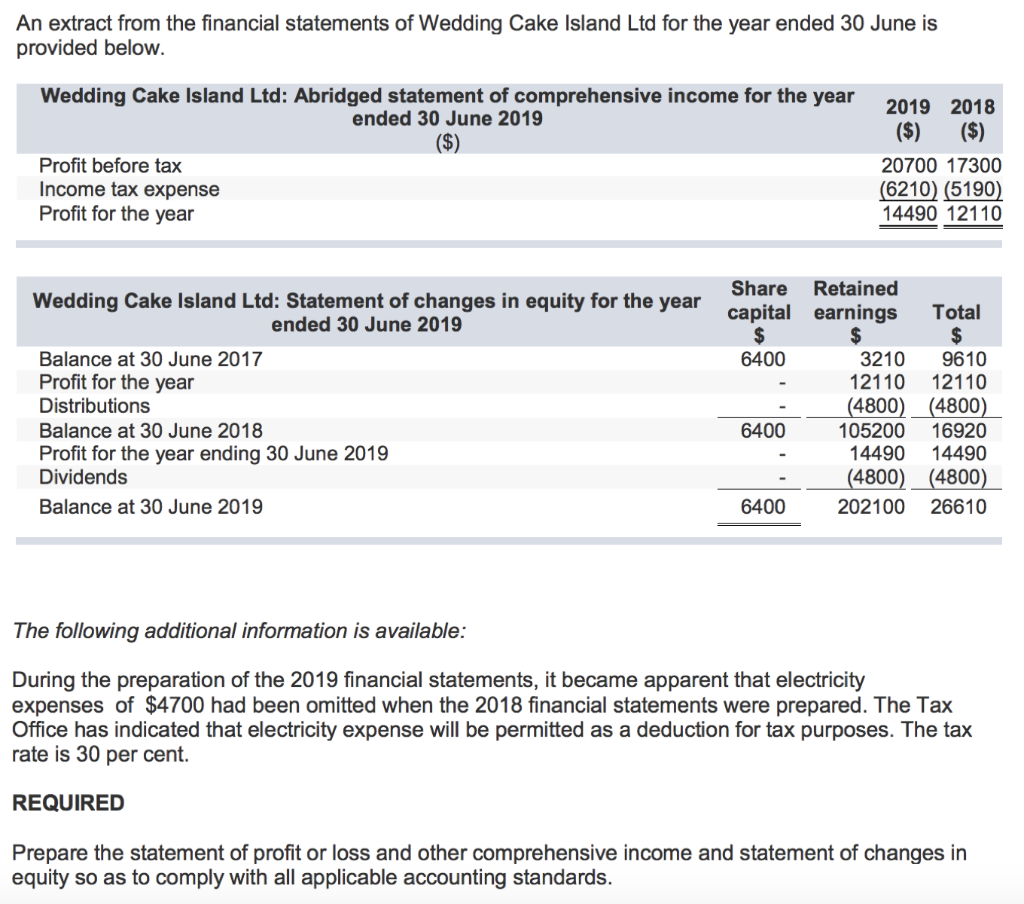

Solved An Extract From The Financial Statements Of Weddin

Solved An Extract From The Financial Statements Of Weddin

20 Overlooked And Unusual Tax Deductions You May Be Eligible For

20 Overlooked And Unusual Tax Deductions You May Be Eligible For

![]() Using Excel Spreadsheets To Track Income Expenses Tax Deductions

Using Excel Spreadsheets To Track Income Expenses Tax Deductions

Get A Tax Break For These 4 Wedding Expenses Smartasset

Get A Tax Break For These 4 Wedding Expenses Smartasset

What Type Of Education Expenses Are Tax Deductible Tax

What Type Of Education Expenses Are Tax Deductible Tax

4 Quirky Tax Deductions That Could Save You Money

4 Quirky Tax Deductions That Could Save You Money

0 i e to "Are Wedding Expenses Tax Deductible"

Post a Comment